Fed messages all point to inflation

At the beginning of the year 2022, the FED has come to confirm that the party is definitely over: the dumpsters of cash poured in for years and with which the markets have been stuffed, will irretrievably dry up, and even faster than expected.

Because inflation is here and there, and Jérôme Powell clearly stated that the priority objective of the institution remained to prevent it from becoming established permanently. Immediate consequence, the FED announced that it would end its bond purchases in March, that it will probably raise its rates as early as March as well, and that she could well do the same at each of her meetings, or even consider an increase in 50 basis points at once if the need arises. The “significant” reduction in its balance sheet will follow immediately.

This is not the message the markets wanted to hear! Rates were quick to react, the 10 US years now far exceeding the 1,80%, and the German Bund having returned to zero. As for France, it must now resolve to pay interest again on its OAT auctions (0,30% during the award of the 6 January). Of course, the stock markets didn’t like it either, and over the month, l’Eurostoxx 50 lose 3,29%, le Dow Jones 5,97%, THE&P500 8,73%, and the Nasdaq 13,44%. All eyes will now turn to the ECB and listen carefully if Christine Lagarde manages to maintain the firm and reassuring message mentioned during her last intervention.

In this context, Equity Income limits its decline to 0,74% on class I, while Cosmopolitan Global stands out by winning 2,66%.

Points importants

- central bank: The Fed has drastically changed its tune on inflation. Futures contracts value at 100 % the chances of an increase in 25 basis points in March and 100 % the chances of a further increase in May and June. Unfortunately, the Fed waited too long to reduce quantitative easing or change rates (she should have done it last year) and if it continues its momentum by raising rates four times and ending quantitative easing at the same time, it will crash the markets and create a great recession. Keep in mind that the Fed added over $3 trillion in QE, it will not be easy to reduce this type of stimulus.

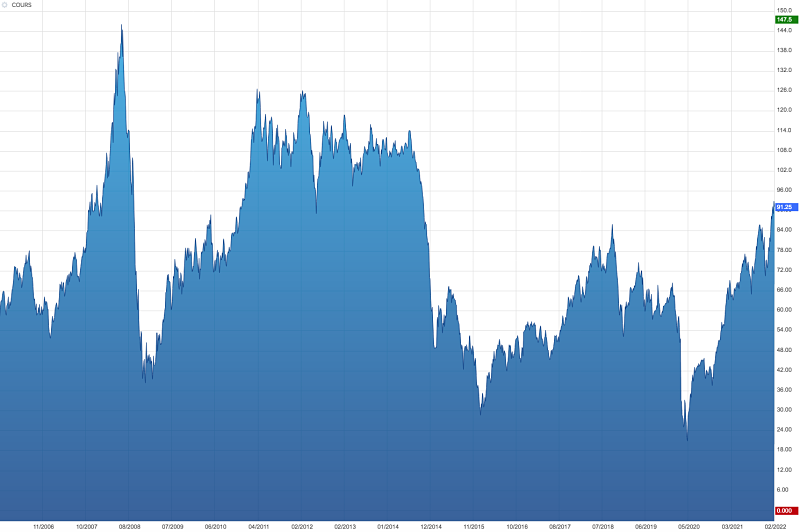

- Oil: black gold has just reached levels of 90,00$ never seen since October 2014. The next great psychological resistance is to 100$. Oil companies around the world are just catching up to pre-crisis price levels, while their dividends are high, but most investors are not participating in this rally, because the big oil companies are the new tobacco manufacturers…

Central banks created this mess with unnecessary quantitative easing and stimulus that they should have stopped long ago. All speculative parts of the market, i.e. companies that are losing money, overvalued growth stocks, ESG values, SPACs, cryptocurrencies and crowded sectors, suffer the consequences of poor valuation and inadequate allocation of capital to assets. NOW, the big question is how low does the stock market have to go before the Fed capitulates and becomes less hawkish ? We believe that another downward movement in 3 to 5% would be a first step. The Fed has already started walking back some of its more optimistic comments about aggressive rate hikes 50 basic points at March meeting.

Annoying call

- Selling “carbon-free” companies short, all of which have lost more than 50% since November 2021.

- Long position on energy, oil and gas. Long positions on EU banks, as the ECB will have to follow the lead of other central banks in removing stimulus measures as inflation hits voters.

- Long position on US 10-YR and partial long position on US 2-YR because we believe the market is pricing in too much upside in the United States.